My Teacher Alexis Rygaloff.

Some time ago, as I had studied about

PRC for some time before really even trying at Mandarin and then even

taking a class at it, I met with Alexis Rygaloff on a winter morning

during a time at which China had, and this through the papers,

started having a more important industrial base that produced more

quality products, though this had nothing to do with our talk at the

time. We neither met as colleagues as Rygaloff was much older and an

experienced teacher at the time, but insofar as I had dropped in on

his class several times and was learning, we both expressed an

interest in this process given my situation at the time. It had been

a custom at the time for many instructors when meeting with students

to actually say very little, and I have no idea how such “mentoring”

sessions take place today nor the protocols involved, nor what people

really say to each other, but we did have some exchange of political

language and some dialogue about his very interesting and informative

mandarin grammar book.

His point to me was that he worked hard

at his articles and books originally, and as a result had plenty of

moneys and some creature comforts, indeed more than the average

senior instructor at the time; I could have his tobacco if I believed

I needed that, his jacket to keep warm in the weather, access to the

books in his library – as all these were considered replaceable and

fungible and he wanted to encourage me in my studies to the extent

possible while persuading me his system of economic provision,

academics, and other statuses would be of great help to me in

continuance of any pursuit of the subject matter at hand. The way in

which this was presented was greatly sophisticated and not without

the proviso that I do work and according to accepted methods, etc. I

was reminded during this quite important conversation that many of

his colleagues, if not he himself had been at Cambridge in U.K., and

extremely liked and admired the situation there and this for me

proposed the danger of being blind to some circumstances and issues

as many of them are: Mr. Rygaloff, while a gifted teacher and so

forth, probably was indeed hardly aware of the economic terms, actual

economics / commerce / business reasons about how he had his position

and salary, of how he was able to afford his travels and worldly

goods, and despite his outstanding grammar publication that I read

through several times for its overall simplicity and heavy impact on

Western speakers of mandarin (as an official language in PRC only,

might I add here), the way he could maintain his teaching without

much effort, maintain a following quite easily and so forth, again.

When this topic entered my mind, in our brief meeting together early

that winter afternoon, I raised my voice in mentioning my impression

of this and how it was inappropriate and irresponsible for he and his

colleagues to have accepted things on a political basis only, and

then to have more or less lain in wait for 'tourists' such as myself

to arrive while making all attempts to learn, and with all our

efforts gleaning maybe about as much mandarin language and culture as

was in the cuticle of his left – hand small finger. This is not an

understatement, nor is nor was in our conversation the tone of

forgetting about themes such as the hundred flowers, Great Leap

Forward, and other ideas presumably designed in Moscow (1958 –

1971) that cast so many lives at least adrift if not into an abyss,

of which an objection to his lessons I raised at the time. The reply

was more or less, “what I have is yours as well”. To this day, I

consider this sort of assertion by anyone as that of a confused and

unfortunate party under the circumstances who held very tight, in

fact after at one time probably having met people in the Kremlin if

not Khruschchev, Brezhnev, Andropov, and Tchernenko themselves – so

many of them travel to Russia in the course of their careers even

today – to these sorts of things very unsure and unclear, and again

about what things like property rights, other rights, and everything

from personal autonomy of the reasonable and prudent person to

territorial sovereignty actually are. Given the great losses they

suffered at the time in the old countries, in fact with the open

refusal of a part of the young intelligenstia to follow these

socialistic ideas and principles, eventually were mostly due to these

very well – trained and smart people having spent academic and

other currency, all socially oriented, toward persuading the youth at

the time and giving the overall impression that capital production

and Western economics and systemic institutions such as common law,

supply and demand including laissez - faire, Christianism and other

'isms' of the great Western powers, the establishment of the family

and institution of marriage, commercial enterprise, multi – party

politics and all this comprised the exploitative evil that caused

systemic problems everywhere, and that essentially capitalism and its

character are responsible for the world's ills and had been for a

long time. The dismissive attitude that “J.P.” and everyone in

the educational system where I attended college of the crimes of

Stalin, Mao, and lesser autocrats in my view, and with respect to

what Rygaloff would mention even today, gave direct cause for this

insofar as survival of any elite or governance in the near abroad of

Eastern Europe, Eurasia and Asia (including especially East Asia).

Evidence of this had been a small, well – funded and extremely

unpopular status of the communists' political parties for years in

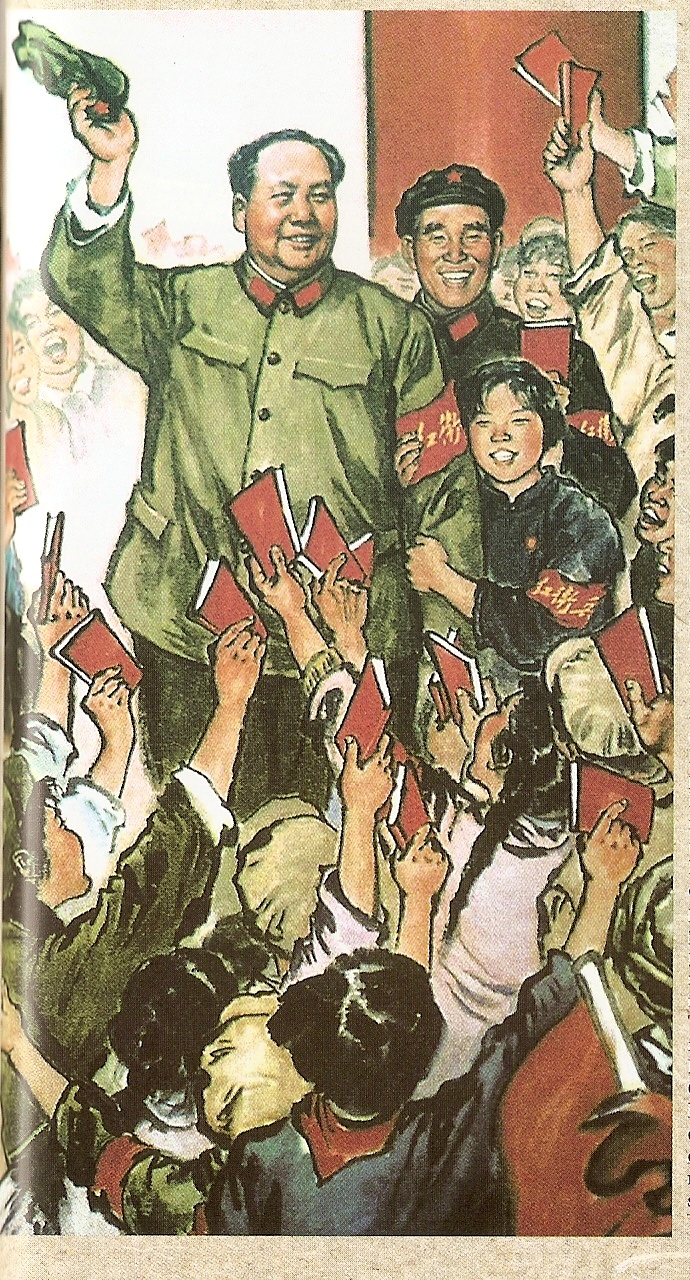

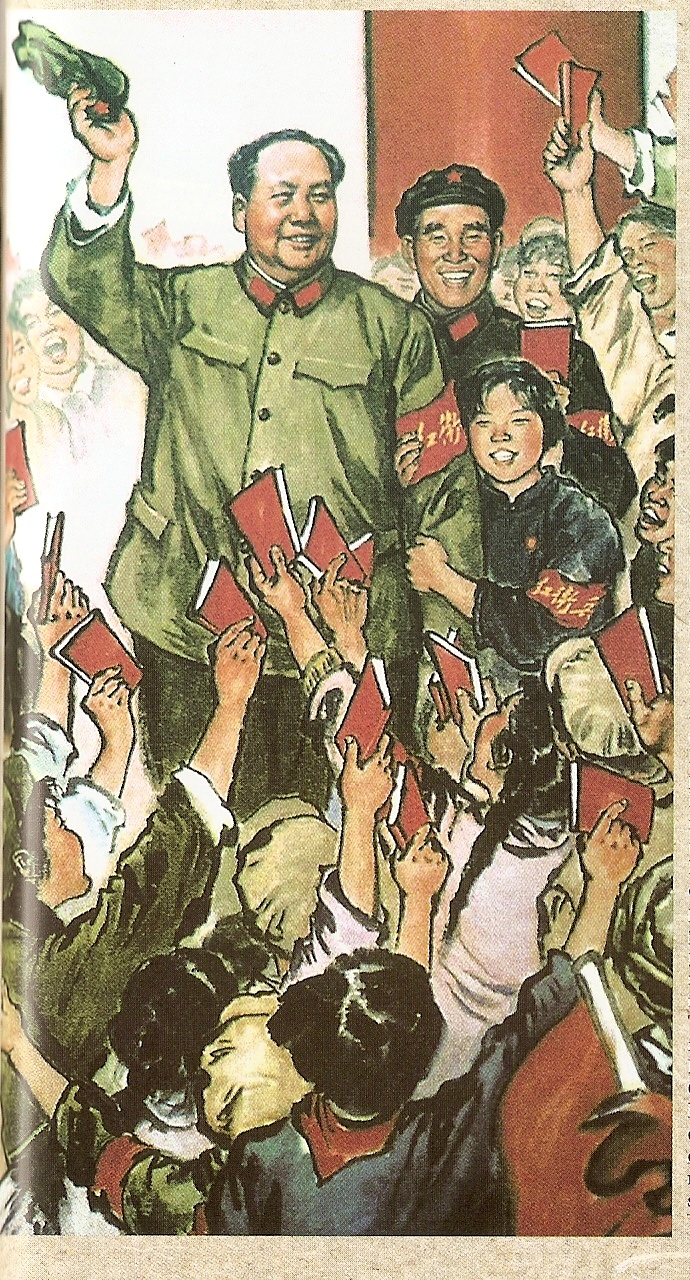

European and Western countries. The influence of Josef Stalin in his

day on our instructors like Rygaloff, that of Mao Zedong, and of

those who held these monumental figures as a model, for a long time

has been that of the exercise of raw – power politically, however

stilted, biased and misguided – oriented to the benefit of quite

narrow and drunken elites who had seized governments and worked to

preserve a systemic tone that had to do with making the world “new”

again and casting aside much of what makes the character of thinking

and being of most all people, regardless of whether they are

intellectually aware of themselves, in the name of social progress.

As much I have been able to tell people like Rygaloff eventually

passed trying to resolve these sorts of dilemmas brought about by

bloody leaders in those places.

The point of this is recently I

attended an event where mandarin is all the rage and remembered

Rygaloff's book on grammar that proposes most if not all people in

PRC get along with about fifty phrases, the rest of the language is

built on those fundamental sentential images. Mandarin overall is a

language with lots of range and difficult to handle in the minutae

that people like him studied, and this probably because many Chinese

speakers have no idea grammatically of this important idea about the

narrowness of their spoken word. Most people for their use of

language are stuck in their proper castes in these regimes where

party ties and the governance itself in many respects depends upon

many mysteries in the workings of the ruling elite. People in this

environment are raised to live with this, and the interpretation of

Western systems as crazy, elitist, exploitative and so on, as part of

the controls on the politics of the things where they carry on their

lives everyday which smacks of a kind of guiding and ruling principle

of parasitism by one's elite on the rest of society along with the

purposeful demonizing of any regional exterior. This overall trust

as established by the ruling party, and the kind of cultural monopoly

it has with respect to the populace in places like PRC, leaves little

room for personal freedoms, much less for the free flows of capital,

goods and services, making for magical and mysterious, and though

recently extremely well – managed, effects on society that are of

marginal benefit only to the common – sense individual in those

countries. Mandarin itself is a language that has great imagery and

descriptive qualities including actually great linguistic range, and

while its influence at least gets necessary attention from more and

more people, needs be regarded with the present fervor about it not

as a key to life as some would have it, but ascribed the proper

requirements and character of something indeed as

increasingly expensive and magical culturally along a learning path:

That would render it ancillary or secondary to the purposes for which

it is sometimes used, for example, to make one understand and use

communist dialectics, or to have one reason in the West that commonly

voting socialist or communist is valuable for one and for others, or

other such critical themes within the purposes themselves of those

attending social and / or professional events with such ideas as an

avocation, or that are used again for instance along with civil

rights (in this to the neglect of civil obligations themselves) in

the banter and casual dialogue of the collectivity given the

occasion. As much in part, along with the lessons of political survival in view of monumental political adversaries and their vassals and various pawns, this instructor indirectly imparted in his provincial, almost Romanian, yet extremely serious and meticulous approach to the language and culture. Enough, already.

|

| Media Photo |